How to Do Market Research for E-commerce: A Complete Guide

More than a fifth of global retail sales were conducted online in 2024; however, over 80% of newly established online stores shut down within their first year and a half. Market research is one of the factors that most determine the fate of these companies, which is often the difference between their survival and disappearance.

Pre-launch growth strategies like chasing traffic and throwing money on ads are typical of most founders, who, however, fail to realize the importance of knowing precisely their consumer profile and buying motivators. Hence, the real deal success journey is entrenched in data, dialogues, and trends through which businesses get to know their target's buying rationale and where their products take part in that journey.

How to perform the right market research to gather the best insights and then apply them for strategic business moves, talent implementation, and predictable profits is what we are going to examine.

1. E-commerce Market Research Defined

Market research in e-commerce is a careful and deliberate process that involves collecting, understanding, and explaining information about the target consumers, competitors, and the industry.

While traditional research mainly features surveys, ecommerce research combines customers’ behaviors, search intent, and current consumer data to show what and why people buy online.

Illustration-wise, current studies, such as search trends, product critiques, and cart abandonment data unveil more face-to-face than habitual surveys, revealing fresh ideas like underestimated product expectation or purchase barriers caused by the buyer’s emotion.

In short, it goes a long way in market research as it is now a process of maintaining and updating the contemporary feedback model that is continuously sharpening your decision-making.

2. Benefits of Market Research for E-Commerce Businesses

E-commerce is not a field where you can afford to rely on wild guesses. The clarity of your marketplace informs the whole array of activities from product conception to campaign positioning, and it also guides your decision on ad spend.

The proper execution of the research first confirms the viability of your ideas before you make a significant investment, thus contributing to the following:

- Uncover the products that buyers want,” instead of just guessing.

- “The part of the market that is not just profitable but also viable in the long run, instead of the one that is overcrowded.”

- Measure the buyer’s mood directly through your advertisement and product positioning.

- Put the money you have for advertising where it will cause the biggest impact on your business.

A report by Statista in 2025 indicated that online businesses that track their target audience behavior regularly and conduct structured market analysis have 32% better customer retention and 40% campaign efficiency than those that rely only on intuition and ad metrics.

This is the compounding effect of being continually informed, making fewer mistakes, and growing at a faster pace.

3. Target Market Understanding

Targeted consumers are identified by their psychology, objectives, and online behavior, not just demographic factors such as income or age.

Nowadays, the consumer of today is more demanding and anticipates, among other things, a personalized interaction as well as social proof before buying, a quick service, etc. So, once you get the rationale behind the behavior, you will be in a position to implement personalization that will drive everything from sales to product recommendation guidance.

Opening up a door to user behavior analysis for your site, you may employ Google Analytics 4, Hotjar, and Crazy Egg kinds of software. These instruments will facilitate comprehension of user navigation on the site, visited pages, their point of exit from the site, and which call-to-actions have brought users to conversions/diversions.

Together with sources of qualitative consumer data, through written reviews and chat support, the understanding of consumer behavior will increase. Sometimes, those “petty” complaints are actually purchase hesitations that the data would not tell you.

4. Analyzing Competitors in E-commerce

Competitor analysis is not about copying, but understanding.

Competitive analysis aims to identify where they find their customers. By examining the customer journey on their site, investigating their pricing model, reviewing content, and analyzing their ads, it is an ample opportunity to learn a great deal regarding what their success looks like. You can also take some time to analyze their major keywords and traffic, which contribute to their overall success, using a few simple tools like SEMrush, Ahrefs, and SimilarWeb.

Pure numbers don’t show everything. Analyzing their communications, the tone, and the feelings that they trigger would be an accurate measure. One of the main reasons for a rival’s rapid campaign becoming popular is a matter to be looked into: is it the timing, tone, or the less saturated niche?

As highlighted by Shopify’s 2024 report, brands that conduct competitor research at least quarterly are able to leverage the lessons learned from others’ trial-and-error and go to market with new products 28% faster.

5. Discovering Trends and Opportunities in the Market

Identifying market trends early can revolutionize your growth trajectory.

Two phenomena of recent years are the “quiet luxury” movement in fashion and the popularity of the DTC health sector. Those businesses that spotted the shifts in trends beforehand reaped the benefit of becoming the leaders of the category.

To detect shifts like these, one must use quantifiable instruments alongside observance of consumer forums, Reddit discussions, and niche newsletters.

Meanwhile, this combined approach enables you to observe early signs such as altered views toward materials, pricing models, or sustainability long before they become common knowledge through traditional data.

6. Tools for E-commerce Market Research

Ecommerce research prospers with the aid of technology. Here are some tools professionals rely on most when building online business insights that they can count on:

- Google Trends: It is the first choice for identifying search interest variations across regions.

- SimilarWeb: It can be used to check the traffic sources, audience overlap, and engagement numbers.

- Jungle Scout / Helium 10: It is a tool for product research on Amazon and demand validation.

- Statista, NielsenIQ: It represents the source of macroeconomic and category-level trend reports.

The issue is not merely using these tools, but combining data from several platforms. For instance, a keyword spike found on Google Trends may be verified with a product search on Amazon to find out if actual purchasing intent is at play.

7. Conducting Surveys and Customer Feedback

Surveys increase their power when they are conversational rather than corporative. If you replace the question “Are you satisfied with our product?” with “What almost stopped you from buying today?”, you will get more feedback.

Typeform and Qualtrics are just two examples of platforms used for surveys, and they can assist you in analyzing the survey results based on factors like purchase history, device type, or traffic source. These behavioral insights help companies to top their sales strategy.

Group surveys, along with review analysis and live chat logs, for a comprehensive 360° view of customer sentiment. Such a combination of data usually reveals hidden areas, for instance, the reasons why customers abandon their shopping carts at checkout or why specific SKUs are going under.

8. Using Google Trends and Analytics for Market Insights

The combination of Google Trends and Analytics offers a powerful way to see what’s changing outside and inside your brand simultaneously.

Trends data reveals global curiosity about what people want. Analytics reveals on-site behavior, what people do. Together, they provide both the desire and the decision view.

For instance, during the “quiet luxury” boom of 2023, fashion retailers who matched trending minimalist keywords with their conversion data saw a 65% increase in engagement and reduced ad waste.

9. Social Media Insights for Market Research

Social media is a composition of human behavior, and no longer are platforms just straightforward marketing tools.

Hashtags, mentions, and comment threads are tracks to uncover unfiltered customer perspectives. Using software like Sprout Social or Brandwatch, you cannot only identify changing sentiment, emerging discussions, but also the type of content that is most attractive to customers.

Say, a beauty brand might find user-generated tutorials to have higher engagement than influencer ads, then it would have to adjust its e-commerce marketing strategy accordingly. Social listening in real-time is what makes your brand adapt to the pace at which your audience keeps.

10. Evaluating Product Demand and Pricing

Getting to know product demand and picking the right price is done through a combination of logic and psychology.

Google Keyword Planner, Helium 10, and other keyword analysis tools provide projections for searches and trends of the season. However, making this data meaningful requires integrating it with review sentiment, competitor pricing, and actual sales data.

According to a 2024 Deloitte report, e-commerce brands that deployed AI pricing models saw profits go up by 19% while the volume of sales remained stable. The smartest pricing strategy is not about being the cheapest but rather about being recognized as fair and valuable.

11. SWOT Analysis for E-commerce Businesses

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, and is a way of turning scattered insights into a game plan.

For instance:

- Strength: Strong SEO visibility and brand recall.

- Weakness: Low repeat purchase rate.

- Opportunity: Rising demand for subscription-based models.

- Threat: Platform policy changes are increasing ad costs.

This structured view helps prioritize actions. It tells you where to invest, what to fix, and which market forces you must prepare for. It’s a cornerstone of sound business strategy.

12. Segmenting Your Market Effectively

Segmentation is no longer about “men aged 25-35.” It’s about behavior and intent.

Modern e-commerce players use behavioral data, psychographic data, and value-based data. Combining these helps you personalize experiences and build loyalty.

For example, an online apparel brand might create unique experiences for “frequent returners,” offering sizing guidance and visual try-ons to reduce churn. When done right, segmentation increases lifetime value and reduces acquisition cost, the holy grail of ecommerce insights.

13. How to Use Market Research Data for Marketing Strategy

This is where the power of Ecommerce Marketing and Development Services comes in. Turning insight into execution requires technical and creative alignment.

Use market research data to:

- Design ad campaigns that mirror your audience’s real pain points.

- Adapt your website UX to reflect the purchase behaviors you’ve identified.

- Build content strategies that answer high-intent search queries.

Take Glossier, for example. They built their brand almost entirely by listening using community feedback to shape both products and messaging. That level of customer collaboration transformed their audience into advocates, not just buyers.

14. Common Mistakes to Avoid in E-commerce Market Research

Even experienced founders fall into these traps:

- Using generic data: Global stats don’t always reflect local buying patterns.

- Focusing only on competitors: Your customers define your growth, not your rivals.

- Not validating assumptions: Always A/B test insights before scaling.

Many brands treat analytics as the finish line when it’s actually the starting point. Real insight lies in interpretation, connecting what the data says to what the customers mean.

15. Case Studies: Successful Market Research in E-commerce

- Nike’s “You Can’t Stop Us” campaign originated from research showing a surge in home fitness interest during lockdowns. Nike pivoted instantly, boosting engagement by 31%.

- Allbirds managed to leverage the enthusiasm for sustainability to turn its environmental data into a revenue generator of $300M by 2024.

- A customer of ours, a medium-sized apparel company from the US, was able to make the most of our Ecommerce Marketing and Development Services to carry out behavioral analytics for the redesign of their checkout flow to get back a 27% increase in conversion rate in only 3 months.

Using data from the user’s point of view for decision-making, rather than following one’s gut feeling or making assumptions, is what lies at the core of these success cases.

Final Thoughts

Data without curiosity is just noise.

True online store research is about connecting patterns that others overlook. Every dip in traffic or surge in engagement tells a story. The question is whether you’re listening.

E-commerce winners aren’t those who spend the most on ads, but those who understand their markets deeply enough to move first, adapt fastest, and evolve continuously.

Market research is crucial for eCommerce businesses because it helps you understand who your customers are, what they want, and how they shop online. It allows you to identify gaps in the market, evaluate demand for your products, and develop strategies that meet customer needs. By analyzing data on competitors, pricing, and consumer behavior, you can make informed decisions that reduce risk, improve customer satisfaction, and boost overall sales performance.

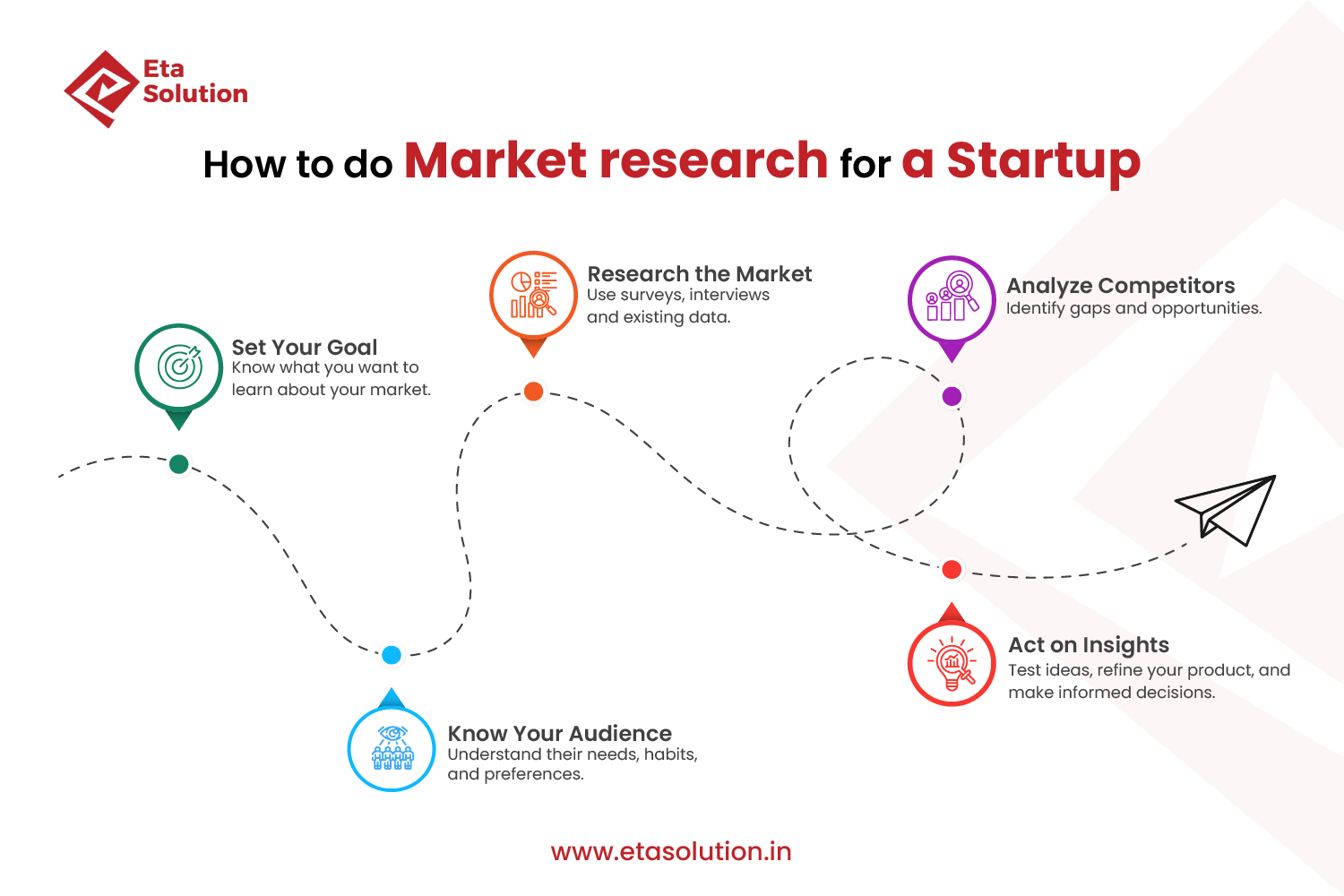

The market research process involves several key steps:

Define your goals – Identify what you want to learn, such as customer demographics or product demand.

Identify your target audience – Understand who your potential customers are based on age, interests, and buying behavior.

Analyze competitors – Study their pricing, marketing strategies, and customer reviews to find gaps or opportunities.

Collect data – Use surveys, interviews, analytics tools, and keyword research to gather valuable insights.

Interpret and apply insights – Turn your findings into actionable strategies for marketing, product development, and sales.

Some of the best tools for conducting eCommerce market research include:

Google Trends – To understand product search trends and seasonality.

SEMrush / Ahrefs – For keyword and competitor analysis.

SimilarWeb – To study traffic sources and performance of competitor websites.

Statista – For reliable industry and market data.

Social listening tools (like Brandwatch or Hootsuite) – To monitor customer conversations and brand mentions.

These tools help you make data-backed decisions that enhance your online strategy.

If you’re a small eCommerce brand, you can still do effective market research without spending much. Start with free tools like Google Keyword Planner for keyword insights and Google Trends for market patterns. Analyze competitors manually through their websites and social media. Read customer reviews on Amazon or Reddit to understand buyer pain points. You can also run low-cost surveys using Google Forms or social media polls to gather direct customer feedback.

Competitor analysis is a key part of market research because it helps you identify what’s working in your niche and where you can outperform others. By studying your competitors’ product range, pricing, website design, SEO strategy, and customer feedback, you can spot weaknesses or gaps in the market. This allows you to refine your own product offering, differentiate your brand, and create marketing campaigns that attract the right audience.

What started as a passion for marketing years ago turned into a purposeful journey of helping businesses communicate in a way that truly connects. I’m Heta Dave, the Founder & CEO of Eta Marketing Solution! With a sharp focus on strategy and human-first marketing, I closely work with brands to help them stand out of the crowd and create something that lasts, not just in visibility, but in impact!

How User Intent Drives Modern Search Strategies

20 Marketing KPIs to Track & Improve in 2026